How Much Does Corvette Insurance Cost? Traditional vs Specialty Coverage Guide (2026 Rates)

Intro

Corvettes are fast, valuable, two-door performance cars that beckon you to drop it into third and let your Kentucky V8 howl.

However, because they’re not a Toyota Corolla or a hybrid crossover, Corvettes are also enormously expensive to insure. After all, any car built to burn rubber is going to cost an arm and a leg for halfway-decent coverage.

Or will it?

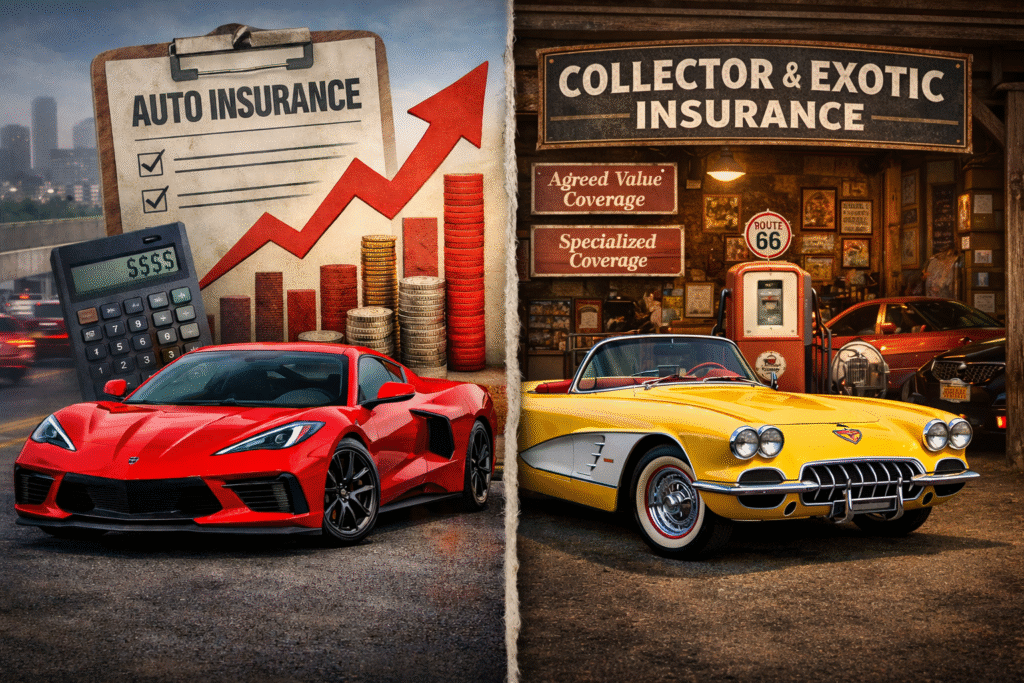

In truth, while a Corvette owner may pay significantly higher premiums with a traditional auto insurance provider, you may find that a specialty insurance provider – who better understands both car and driver – can offer better protection at potentially lower rates.

So let’s explore how much Corvette insurance costs with a traditional vs. specialty provider, how high-value ‘Vettes like the Z06 factor in, and how something called “AVP” helps Corvette owners nationwide sleep better at night.

Average Corvette insurance costs by model and generation

How much does Corvette insurance cost for each generation of the American automotive icon? Are some generations significantly cheaper – or more expensive – than others?

To find out, we anonymously collected quotes from a major insurance provider using a typical Corvette driver profile:

“Ralph Lauren” is a 57-year-old Kentucky resident with a clean driving record and a garage. Since he owns multiple cars, he drives his ‘Vette less than 4,000 miles per year. He also wants robust coverage for peace of mind: that means $250,000/$500,000/$250,000 in liability limits, plus collision and comprehensive, with a $250 deductible.

As for the vehicles, we collected quotes using roughly the median agreed value for each Corvette generation. In other words, a pretty standard C1, C2, etc. Nothing too fancy (no 1967 L89s).

Preamble aside, here’s what Ralph would pay a traditional insurance provider versus a specialty insurance provider for similar coverage:

| Corvette Generation | Traditional Insurance Quote | Specialty Insurance Quote (NCM) |

| C1 | Unavailable | $500 – $600/year |

| C2 | Unavailable | $500 – $600/year |

| C3 | $800 – $900/year | $200 – $300/year |

| C4 | $1,100 – $1,200/year | $300 – $400/year |

| C5 | $1,400 – $1,500/year | $300 – $500/year |

| C6 | $1,700 – $1,900/year | $500 – $600/year |

| C7 Stingray | $2,100 – $2,300/year | $500 – $600/year |

| C8 Stingray | $2,400 – $2,600/year | $700 – $800/year |

Aside from (potentially) lower rates, why else should a Corvette owner like you consider specialty insurance?

Why Corvettes require specialty coverage

For many Corvette owners, a specialty insurance policy for your prized ride can provide significantly better protection – for potentially less money – than a traditional auto insurance policy.

Here are a few reasons why:

- Agreed value protection (AVP): With AVP, you and your provider will come to an agreement on the fair value of your Corvette before coverage even begins. That way, in the event of a total loss, you’ll receive a check for the agreed value – not the heavily depreciated value, as you typically would with a traditional auto policy.

- Quality parts and labor: Specialty insurance providers understand that classic and high-performance cars require quality parts and skilled labor to restore to pre-loss condition. No slapping Bondo on it and calling it a day.

- Modification-friendly: Let’s say you send your ‘Vette off to Callaway for a Gen4 Supercharger. In the event of a total loss, traditional insurance may not cover your $15,000 upgrade. But specialty providers may offer supplemental coverage to protect your modifications – however big or small.

- Unique discounts: Finally, specialty providers may offer unique discounts to lower your premiums even further. At NCM Insurance, for example, we offer discounts for having an alarm in your garage, having paid membership to select automotive enthusiast groups and special multi-vehicle discounts for collectors.

Stingray vs Z06 vs classic Corvette insurance considerations

In the chart above, you may have noticed that the cost of specialty insurance tends to dip around the C4 generation and peak with the C8.

In fact, the most expensive Corvettes to insure tend to be your mint-condition C1s and tire-burning variants like the Z06, ZR1 and ZR1X.

Why is that?

Ultimately, it comes down to the cost of repairs. Classic, rare and ultra-high-performance Corvettes have parts that are harder to find and harder to fix than your basic, mass-produced Stingray.

In addition, the frequency of total losses (where the cost of repairs exceeds the value of the car) is higher on these more “exotic” variants.

As a net result, if you own a rare Corvette – whether it’s a 1978 Silver Anniversary or a 2026 ZR1 – you might consider a specialty Corvette insurance policy since the benefits over a traditional policy are amplified even further.

How agreed value coverage protects long-term value

Finally, let’s briefly circle back on agreed value protection (AVP) since many owners call it the #1 benefit to having specialty Corvette insurance.

To recap, AVP involves you and your provider “agreeing” on the fair value of the vehicle when you first purchase your policy. Your Corvette’s condition, rarity, modifications and more can all factor into the agreed value conversation.

Once established, the agreed value will not change unless you specifically request an adjustment. For example, maybe you get $10,000 worth of restoration work done, and you’d like your Corvette’s agreed value to increase. Or maybe you’ve put some serious miles on your ‘Vette and you’d like your agreed value to decrease to reflect its current condition (and lower your premiums).

In either case, your next step would be to have a conversation with your special insurance provider to come up with a new agreed value. They won’t change it until you specifically ask them to.

Then, in the event of a total loss, your specialty provider will pay you the agreed value of your vehicle. This can often be thousands or tens of thousands more than the “fair market value,” or FMV, that traditional insurance providers use to calculate settlements.

The bottom line: specialty Corvette insurance can be better, cheaper and more benefit-rich than traditional coverage. Insure your Corvette with a provider built around Corvette ownership. Get a Corvette-specific quote today.